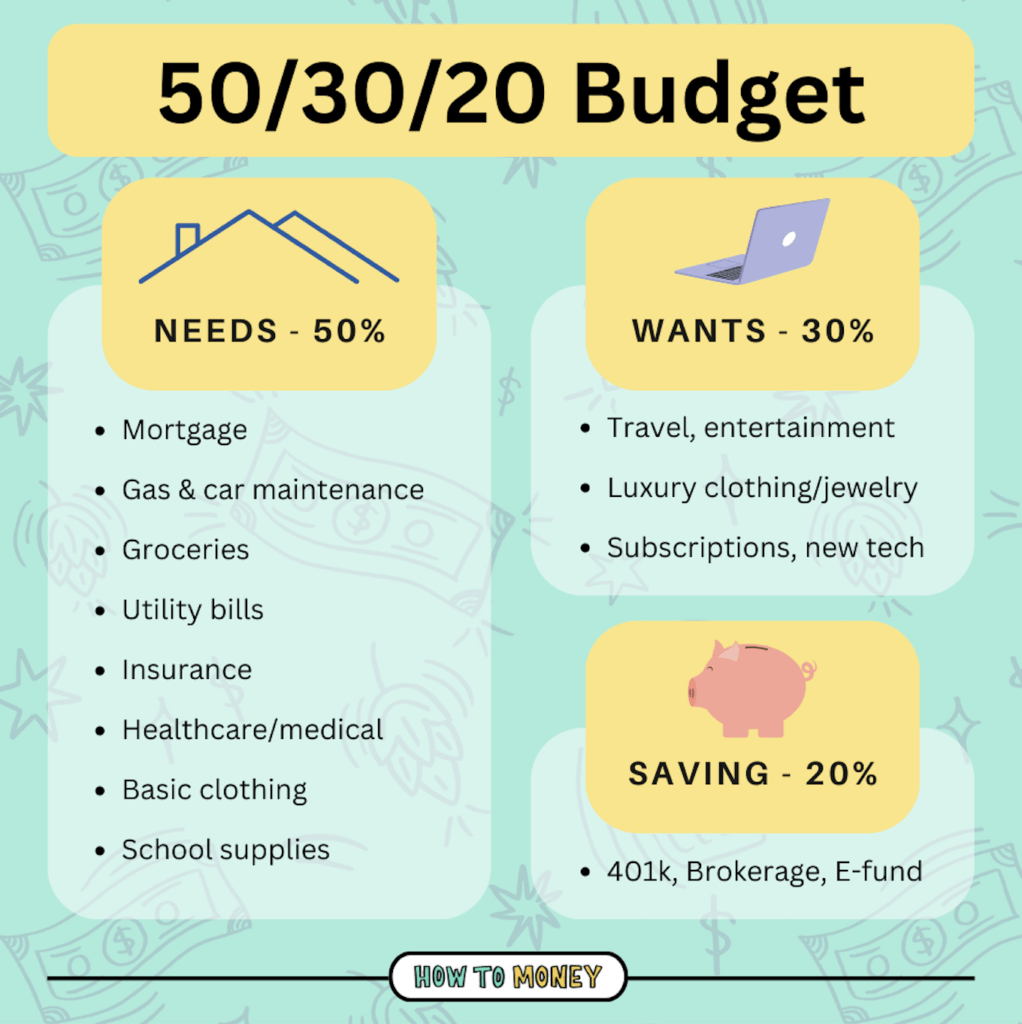

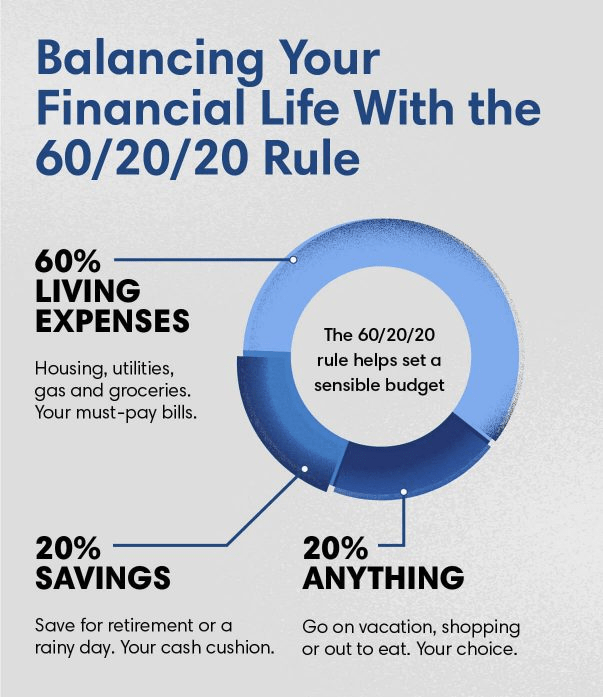

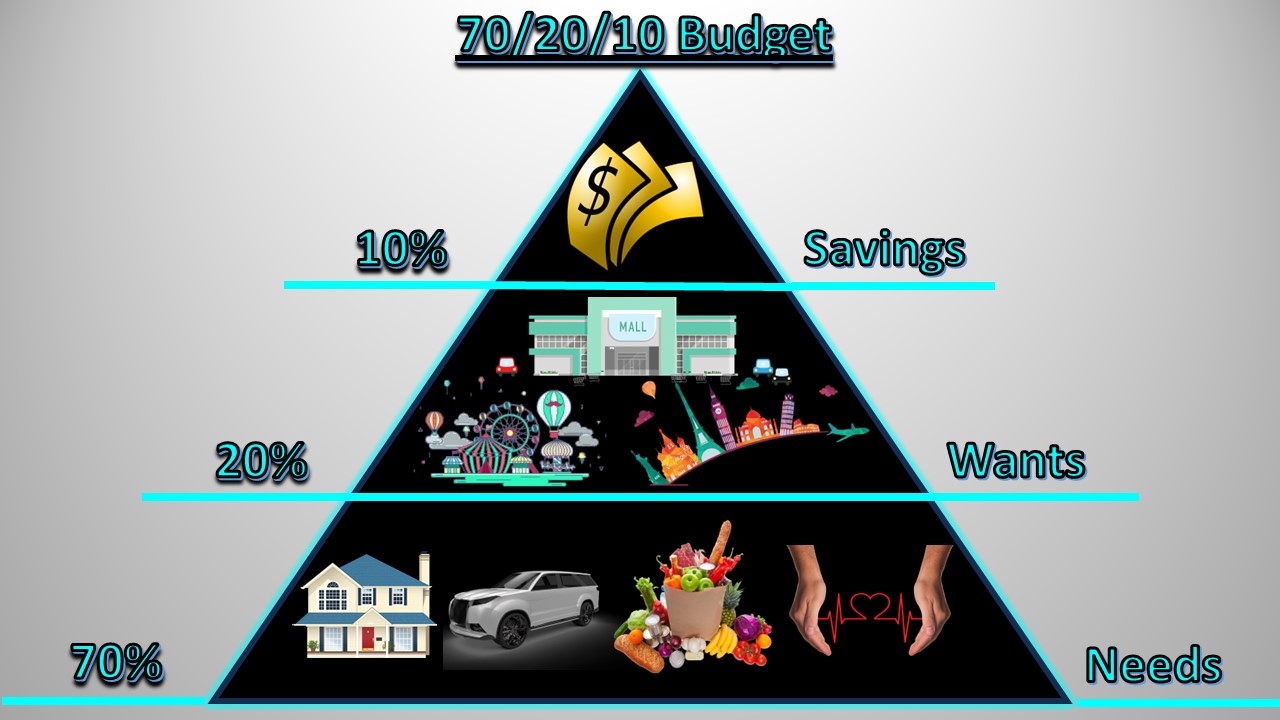

Are you budgeting 50/30/20, 60/20/20, 70/20/10, or not budgeting at all? These are three common budgeting frameworks. Each allocates percentages of your income to different categories: necessities, wants, and savings/investments respectively. However, the best fit depends on your individual financial situation and goals.

That all sounds like a prudent approach to managing your finances but utilizing a structured budgeting system can provide a solid framework for your financial planning. Engaging with Essential Consulting for personalized guidance can offer valuable insights tailored to your specific circumstances.

Moreover, integrating bookkeeping services into your financial management strategy can further strengthen your foundation. Proper bookkeeping ensures accurate recording and tracking of your income, expenses, and financial transactions, which is crucial for making informed decisions and maintaining financial stability.

If you’re uncertain which percentages would suit you best, Essential Consulting is a wise move. They can analyze your income, expenses, and financial goals to recommend a personalized budgeting strategy. They may also provide insights on optimizing your spending and saving habits to align with your objectives.

By combining these elements—structured budgeting, personalized consultation with Essential Consulting, and reliable bookkeeping—you can build a strong financial foundation and work towards achieving your financial goals with confidence.

Leave a comment